It’s no secret that Social Security isn’t doing well, but most people tend to overestimate the severity of the situation. They think Social Security’s going to disappear in a few years, leaving them to fund their retirements completely on their own.

Thankfully, that’s not going to happen. But the reality is still pretty concerning. Social Security’s trust funds will be depleted in 2034, according to a recent Congressional Budget Office (CBO) report. Without government intervention, beneficiaries would face immediate 23% cuts to their checks.

Image source: Getty Images.

Fixes are possible — likely, even — but they come at a heavy price. If you’re already on Social Security or plan to rely upon it in the future, understanding this crisis and the potential ways out of it are critical to preparing for the changes these reforms may have on your finances.

How Social Security gets its money

Social Security’s funding crisis is a multifaceted issue, but it mostly comes back to changing societal demographics. To understand these, it’s important to mention how Social Security gets its money in the first place. There are three income sources:

- Social Security payroll taxes: This is the 12.4% tax, split equally between employee and employer, that all workers pay on the first $168,600 they earn in 2024. It provides the bulk of the program’s funding and brought in more than $1.23 trillion in 2023.

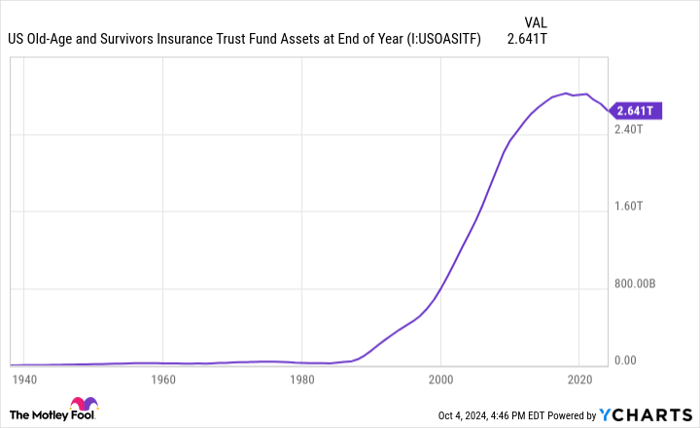

- Interest on Social Security’s trust funds: In the past, when Social Security tax income exceeded expenses, excess money went into a trust fund where it was invested in government-backed securities. The interest earned on these investments generated nearly $67 billion for the program last year.

- Social Security benefit taxes: Up to 85% of seniors’ Social Security checks is now subject to ordinary income tax if their provisional incomes — adjusted gross income (AGI) plus nontaxable interest from their investments and half their annual Social Security benefits — exceeds $25,000 for a single adult or $32,000 for a married couple. These taxes provided close to $51 billion in income last year.

Thanks to these revenue sources, Social Security took in more than $1.35 trillion in 2023 — but it’s not enough. Program expenditures were close to $1.4 trillion last year and are only going to increase as the 2025 cost-of-living adjustment boosts benefits and increases the program’s expenses.

So far, the Social Security Administration has been able to compensate for this shortfall by withdrawing money from the trust funds, but this won’t work forever.

U.S. Old-Age and Survivors Insurance Trust Fund Assets at End of Year data by YCharts

Trust fund reserves are declining, and when they’re gone, Social Security will only be able to pay out what it takes in from payroll and benefit taxes.

Three reasons Social Security taxes aren’t cutting it

For many years, Social Security taxes were more than adequate to fund the program. But a few key changes over the last several decades have made this approach unsustainable:

- Retiring baby boomers: Baby boomers held the title of the largest generation for decades, and that was great news when they were in the workforce because it kept the worker-to-beneficiary ratio high. But as baby boomers have retired, Social Security has had to pay out increasingly large sums to cover all of their benefits.

- Increased longevity: Average life expectancy in the U.S. has risen over the decades, at least until recent years when problems like the COVID-19 pandemic occurred. Longer lives mean more years spent claiming Social Security benefits, which means more beneficiaries claiming at once than in the past.

- Falling birth rates: The birth rate for U.S. women back in 1960 was 3.7. That number fell to 1.7 by 2022. This means fewer workers have replaced the retiring baby boomers in paying Social Security taxes, leading to less income for a program that’s paying benefits to an increasing number of seniors.

Unfortunately, there’s nothing anyone can do to change these issues. That leaves only one option: Change Social Security to accommodate them.

Six potential Social Security fixes

There are essentially two ways to fix Social Security and both have their drawbacks. The first option is for the government to increase its tax revenue. It could do this in a few ways:

- Raising the Social Security payroll tax rate: The recent CBO report indicates that a permanent 4.3% increase would be necessary to combat the funding shortage. That would cost someone earning $60,000 per year another $2,580 annually.

- Raising the Social Security benefit tax rate: This would reduce the benefits available to seniors to cover their living expenses.

- Raising the ceiling on income subject to Social Security taxes: This would raise or eliminate the ceiling on Social Security payroll tax ($168,600 in 2024). It’s the most popular of the tax-increasing proposals because the burden to pay more falls on the wealthy. However, this wouldn’t be enough to solve the shortfall on its own. A recent University of Maryland study estimated it would only cut the shortfall by 60%.

The other way to fix this problem is to reduce benefits. Again, there are a few options here:

- Cut benefits for everyone: The CBO report estimates a 24% benefit cut would be necessary to fix the shortfall. That would drop the average benefit from $1,920 per month as of August 2024 to $1,460 per month.

- Reduce the annual cost-of-living adjustments (COLAs): These are increases that happen in most years to help counter inflation. Many argue that COLAs are already inadequate, causing buying power to decline.

- Raising the full retirement age (FRA): The full retirement age (FRA) is 67 for most of today’s workers, though some older adults have FRAs as low as 66. You can apply for benefits before you reach your FRA, but doing so would shrink your checks by up to 30%. Raising the FRA would subject more workers to these early claiming penalties and make these penalties even steeper than they are today.

There aren’t any easy solutions, and that’s why the government hasn’t done anything yet. Someone’s going to be unhappy, no matter what they decide. In all likelihood, the government won’t choose any one of these solutions alone. It’ll probably take a combination of these and possibly other strategies to fix it.

If there’s one takeaway for workers and retirees, it’s that minimizing your dependence on Social Security is the best way to ensure a comfortable retirement. It’s easier said than done, but if you can diversify your retirement income and maximize your annual retirement savings, you’ll be less affected by whatever the government decides.

The $22,924 Social Security bonus most retirees completely overlook

If you’re like most Americans, you’re a few years (or more) behind on your retirement savings. But a handful of little-known “Social Security secrets” could help ensure a boost in your retirement income. For example: one easy trick could pay you as much as $22,924 more… each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we’re all after. Simply click here to discover how to learn more about these strategies.

View the “Social Security secrets” »

The Motley Fool has a disclosure policy.

benzinga.com

benzinga.com fool.com

fool.com