Social Security is a lifeline for millions of retirees. For many, it’s the only thing keeping them above the poverty line.

According to the Social Security Administration, roughly 40% of beneficiaries age 65 and older rely on their monthly payments for at least half of their income. For 12% of men and 15% of women, benefits make up at least 90% of their income.

However, considering the average retired worker only collects around $1,920 per month, it can be tough to survive primarily on Social Security. Whether you’re going to be depending heavily on your benefits or simply want to maximize your income, there are three strategies to beat the average benefit amount.

1. Delay claiming benefits

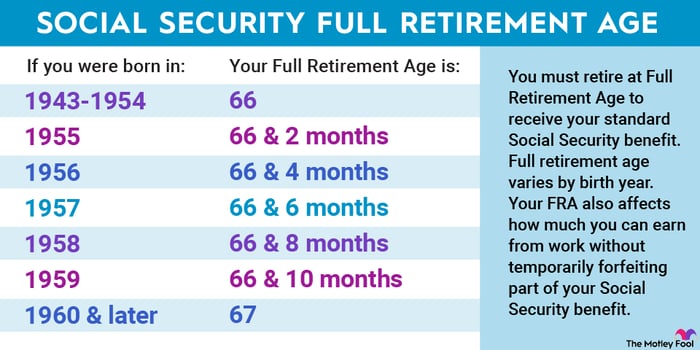

Perhaps the simplest way to substantially boost your benefit is to delay claiming. If you file at your full retirement age, you’ll collect 100% of your benefit. By filing earlier than that (as early as age 62), you’ll receive a reduced benefit. But by delaying up to age 70, you’ll collect your full benefit plus a monthly bonus. In some cases, delaying benefits by even a couple of years can boost your checks by hundreds of dollars per month.

Image source: The Motley Fool.

For example, let’s say you have a full retirement age of 67, and by filing at that age, you’d collect $1,700 per month. By claiming at 62, your checks would be reduced by 30%, leaving you with $1,190 per month. But if you were to delay until age 70, you’d collect an extra 24% on top of your initial $1,700 per month — giving you a total of $2,108 per month. That’s a whopping $918 more per month than you’d collect at 62.

2. Work longer than 35 years

Several factors go into your benefit amount calculations, including the length of your career.

The Social Security Administration uses the 35 years of your career when you earned the most, averages those earnings, runs them through a complex formula, and adjusts for inflation. The result is the amount you’ll collect at your full retirement age.

If you worked fewer than 35 years, you’d have zeros included in your calculations to account for any time you weren’t working. But working more than 35 years can sometimes increase your benefit amount, too.

Chances are you’re earning a higher income now than in the early years of your career. Working a little longer now will ensure that you have more higher-earning years included in your top 35 years of work. That, in turn, will increase your earnings average and give you a larger monthly benefit.

3. Take advantage of other types of benefits

Retirement benefits are only one type of Social Security. There are other types of benefits you could qualify for in some situations.

If you’re married or were previously married to someone who qualifies for retirement or disability benefits, for example, you could be entitled to spousal or divorce benefits. In both cases, the maximum you can receive is 50% of your spouse’s or ex-spouse’s benefit at their full retirement age.

With both spousal and divorce benefits, taking Social Security based on a partner’s or ex-partner’s work record will not affect their benefit in any way. Also, if your ex-spouse has remarried, claiming divorce benefits will not limit their current partner’s ability to claim spousal benefits.

If you’re also collecting retirement benefits, you’ll only qualify for spousal or divorce benefits if that payment is higher than what you’re already receiving. So, for instance, if you’re collecting $1,500 per month in retirement benefits and would qualify for $2,000 per month in spousal benefits, your total benefit would be $2,000 per month.

For those depending heavily on Social Security in retirement, every dollar counts. Small steps can make a big difference, and by taking advantage of any of these strategies, you could boost your benefits more than you might think.

The $22,924 Social Security bonus most retirees completely overlook

If you’re like most Americans, you’re a few years (or more) behind on your retirement savings. But a handful of little-known “Social Security secrets” could help ensure a boost in your retirement income. For example: one easy trick could pay you as much as $22,924 more… each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we’re all after. Simply click here to discover how to learn more about these strategies.

View the “Social Security secrets” »

The Motley Fool has a disclosure policy.

fool.com

fool.com benzinga.com

benzinga.com