In November, close to 52 million retired-worker beneficiaries took home an average Social Security check of $1,925.46. While this isn’t a boatload of money, it’s proved to be a vital source of income for our nation’s aging workforce.

In each of the last 23 years, national pollster Gallup has completed a survey that questions how reliant retirees are on the money they receive from America’s leading social program. Since 2002, 80% to 90% of respondents — including 88% in April 2024 — have noted that Social Security is a “major” or “minor” income source. Put another way, close to 9 out of 10 seniors could struggle to make ends meet if Social Security didn’t exist.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

But in spite of the undeniably important role Social Security plays in shoring up the financial foundations of tens of millions of retirees, this relied-upon program is faltering.

Current and future beneficiaries are counting on their elected officials to strengthen Social Security — and this includes incoming President Donald Trump.

President Donald Trump addressing the nation. Image source: Official White House Photo by Joyce N. Boghosian.

Sweeping Social Security benefit cuts may be only nine years away

Ever since the first retired-worker benefit check was mailed out in January 1940, the Social Security Board of Trustees has released an annual report detailing the financial health of the program. In addition to showing how income is collected and where those dollars end up, the annual Trustees Report projects how financially sound Social Security will be over the long run, which is defined as the 75 years following the release of a report.

For four decades (since 1985), every Trustees Report has forecast a long-term funding obligation shortfall. In simpler terms, the Trustees don’t believe aggregate income collection in the 75 years following a report will be sufficient to cover outlays, including annual cost-of-living adjustments (COLAs).

The 2024 Trustees Report pegged Social Security’s 75-year funding shortfall at $23.2 trillion, which is up $800 billion from the 2023 report.

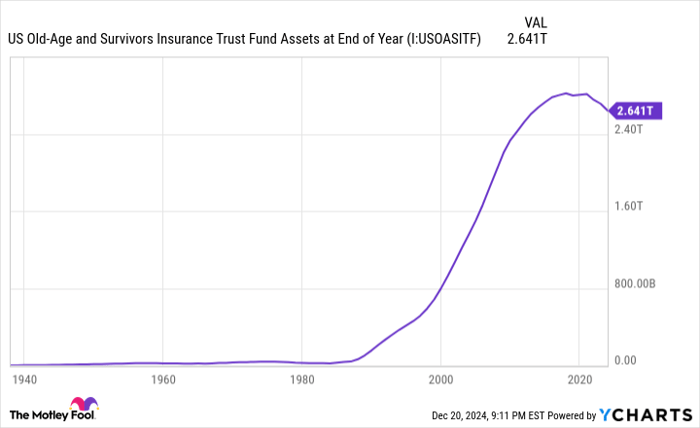

What’s even more worrisome is that sweeping benefit cuts may be right around the corner for retirees. According to the 2024 Trustees Report, the Old-Age and Survivors Insurance Trust Fund (OASI), which is responsible for dishing out payments to retired workers and survivors of deceased workers each month, is forecast to exhaust its asset reserves by 2033.

Before going any further, let’s make clear that depleting the OASI’s asset reserves doesn’t mean Social Security is bankrupt, insolvent, or going to disappear. What it does suggest is that the current payout schedule, including COLAs, isn’t sustainable. If the OASI’s asset reserves are gone by 2033, as forecast, sweeping benefit cuts of up to 21% may be needed to avoid any further cuts through 2098.

Ongoing demographic shifts — not “congressional theft” or “undocumented migrants” — such as a historically low U.S. birth rate and rising income inequality, are the reasons Social Security’s financial foundation is crumbling.

The OASI’s asset reserves are forecast to be exhausted by 2033. US Old-Age and Survivors Insurance Trust Fund Assets at End of Year data by YCharts.

President-elect Trump’s eight words aim to change Social Security forever

Although President-elect Donald Trump avoided tackling the controversial topic that is Social Security during his first term in the Oval Office, presidential candidates rarely have the luxury of taking no stance on key topics while on the campaign trail.

In late July, while posting on his social media platform, Truth Social, the now-president-elect stated eight words that offer a potential promise to change Social Security forever: “Seniors should not pay tax on Social Security.”

Admittedly, this isn’t a bill or even a sketch of a bill. But it does intimate favorability on the part of the incoming president to eliminate the taxation of Social Security benefits.

In 1983, Social Security was in a similar situation to what the Trustees anticipate will happen in nine years. With the program’s asset reserves expected to be depleted, Congress passed and then-President Ronald Reagan signed the Social Security Amendments of 1983 into law.

This bipartisan overhaul of America’s leading retirement program gradually increased payroll taxation on workers and the full retirement age over time. It also introduced the taxation of benefits.

Beginning in 1984, up to 50% of Social Security benefits could be exposed to the federal tax rate if provisional income (adjusted gross income + tax-free interest + one-half benefits) surpassed $25,000 for single filers or $32,000 for couples filing jointly. Roughly a decade later, in 1993, the Clinton administration tacked on a second tax tier that allowed up to 85% of benefits to be exposed to federal taxation in instances where provisional income topped $34,000 for single filers and $44,000 for couples filing jointly.

When the taxation of benefits was initially implemented, it was expected to impact about 10% of all senior households. But since these income thresholds have never been adjusted for inflation, rising COLAs over time have steadily increased the percentage of retirees subject to this tax.

Donald Trump’s implied elimination of the taxation of benefits would likely boost monthly payouts for around half of all Social Security recipients.

Image source: Getty Images.

Trump’s Social Security plan comes with unforeseen consequences

While President-elect Donald Trump’s casual proposal to do away with the taxation of Social Security benefits fits with his overall theme of reducing taxes, this seemingly well-intentioned action could have dire consequences for America’s leading retirement program.

Putting aside the well-known fact that seniors overwhelmingly dislike having their benefits taxed, this income is an absolute necessity for Social Security.

Social Security generates income three ways:

- The 12.4% payroll tax on earned income, which includes wages and salary but not investment income

- The interest income earned on its asset reserves, which are invested in special-issue, interest-bearing government bonds, as required by law

- The taxation of Social Security benefits

With Social Security spending more than it’s bringing in each year, the program’s ability to generate interest income may soon be gone. Eliminating the taxation of benefits would remove another source of income, which by the Trustees’ estimate is expected to generate almost $944 billion in cumulative income from 2024 through 2033 for the combined OASI and Disability Insurance Trust Fund.

In other words, if Trump were to change Social Security forever by no longer taxing benefits, there’s a very high probability that it would expedite the depletion of the OASI’s asset reserves and increase the magnitude of benefit cuts needed to sustain payouts, including COLAs, over the coming 75 years.

Additionally, the incoming president would face the challenging task of getting the 60 votes needed in the Senate to amend the Social Security Act. It’s been 45 years since either party held a supermajority of 60 seats in the upper house of Congress. Even if every Republican senator in the incoming Congress voted in favor of removing the taxation of benefits, Trump would still need seven Democrats to join his cause, which seems highly unlikely.

Though this may not be the last we hear about eliminating the taxation of Social Security benefits, there’s simply no financial incentive for lawmakers to get rid of this necessary income source.

The $22,924 Social Security bonus most retirees completely overlook

If you’re like most Americans, you’re a few years (or more) behind on your retirement savings. But a handful of little-known “Social Security secrets” could help ensure a boost in your retirement income. For example: one easy trick could pay you as much as $22,924 more… each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we’re all after. Simply click here to discover how to learn more about these strategies.

View the “Social Security secrets” »

The Motley Fool has a disclosure policy.

benzinga.com

benzinga.com fool.com

fool.com