Saving for retirement doesn’t happen overnight. It’s a life-long process, so having a brick-by-brick mindset helps you keep your sanity because it can feel like watching grass grow sometimes. The good news is that you don’t have to earn the wealth you need for retirement one dollar at a time.

Yes, I’m talking about compounding. But I’m not talking about piling your hard-earned money into a savings account and sitting tight. No, you have to put your money out into the world, demanding that it earn a return that makes the compounding magic happen.

This is your public service announcement about why and how to invest your way to exponential wealth.

Investing is the secret to generational wealth

I’ll dive right in: Investing your money is the best way to make compounding work for you. It’s the secret to exponential wealth in America, the generational kind that makes you rich and sets up your kids for life, your kids’ kids, and so forth. Did you know the wealthiest 10% of Americans own approximately 93% of U.S. stocks?

This isn’t a game of kings and queens — many wealthy Americans didn’t inherit their money. It’s about owning a stake in the best businesses underpinning America’s capitalist economy, arguably the greatest wealth-building machine the world has ever seen.

Image source: Getty Images.

Sure, you can compound your money by playing it safe. Some high-yield savings accounts still pay 4% to 5% today. If you stash $200 monthly into an account yielding 5% for 30 years, you could have as much as $170,000. It’s better than nothing, but not enough to retire stress-free by most means. But crank that annual return up to 10%, and you’re retiring with a far more substantial $456,000. Plus, interest rates fluctuate, so high-yield savings accounts may not pay that much interest forever.

You have to take a little more risk to earn substantial wealth, and investing is how you do that.

Where to find 10% annual returns

There are endless ways to invest your money, from cryptocurrencies to the hot stock your friends can’t stop bragging about. However, I’m here to tell you about the tried-and-true method that has generated an average annual return of 10% for the past 50 years: the S&P 500 index (SNPINDEX: ^GSPC).

The S&P 500 is a stock market index of 500 prominent U.S. companies representing the best American businesses. Companies must meet specific requirements before being considered for inclusion in the index, which a committee manages with quarterly adjustments. The index is also market cap-weighted, meaning more successful stocks represent more of the index as they grow larger.

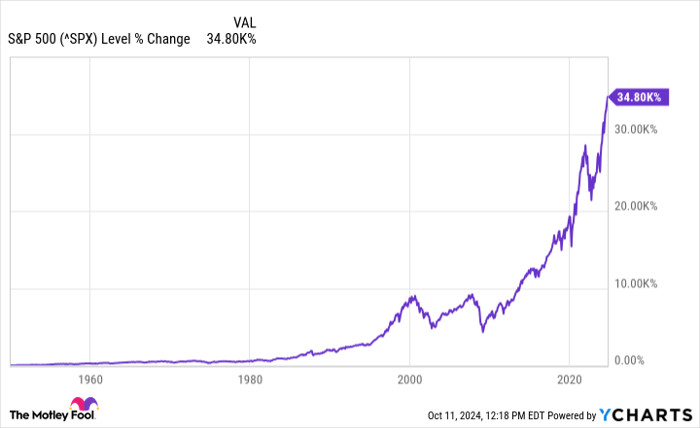

Companies have come and gone from the index since the 1950s, but it has still created staggering wealth over time:

Plan for the volatility of investing

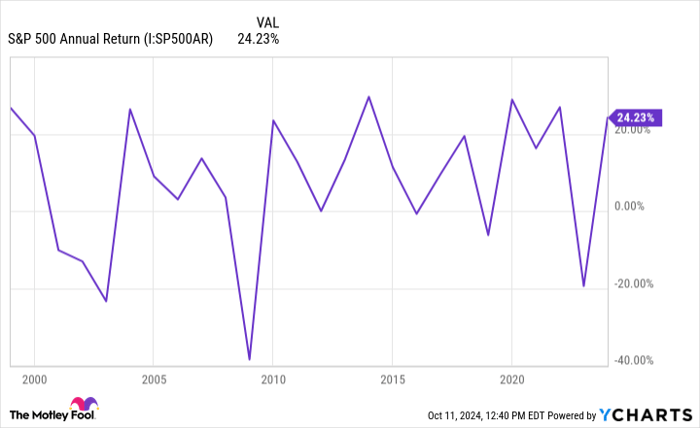

Here is an important caveat. The S&P 500 averages 10% annual returns, but the index’s year-to-year performance can fluctuate wildly. The S&P 500 is already up more than 21% year to date, and it’s only October! Of course, that means the index occasionally swings hard in the opposite direction, too.

As the chart below shows, the S&P 500 goes up and down in the short term:

S&P 500 Annual Return data by YCharts

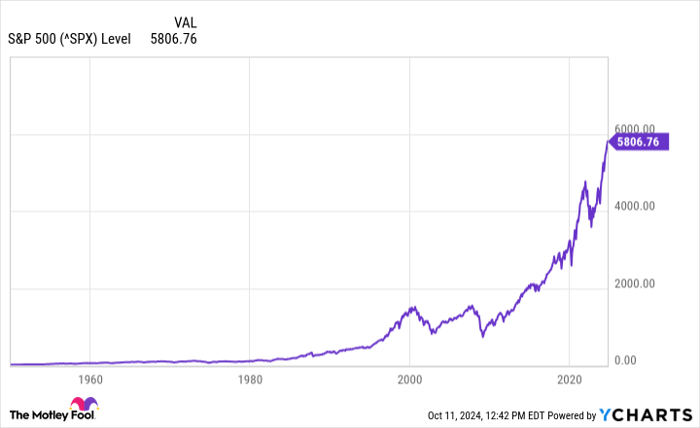

But over time, the growth of America’s economy has lifted the S&P 500 higher:

Nobody can guarantee that the S&P 500 will continue rising over the long run, but decades of historical evidence probably provide as much assurance as you’ll find on Wall Street.

How to take action

The S&P 500 is a great wealth-building tool for anyone trying to build substantial wealth over the coming years and decades. The longer you have for compounding to work, the better.

You can’t directly invest in the S&P 500, though there are index funds or exchange-traded funds, such as Vanguard’s S&P 500 ETF (NYSEMKT: VOO), that copy it. A slow-and-steady investment plan is the best way to deal with the S&P 500’s volatility. Try a dollar-cost averaging strategy and regularly add new funds if you can. Trying to time the market’s ebb and flow generally doesn’t work and makes little impact over the long run if you manage to do so.

If you follow this roadmap and stick with it, you’ll have as good a shot as anyone at building monumental wealth over the coming decades.

The $22,924 Social Security bonus most retirees completely overlook

If you’re like most Americans, you’re a few years (or more) behind on your retirement savings. But a handful of little-known “Social Security secrets” could help ensure a boost in your retirement income. For example: one easy trick could pay you as much as $22,924 more… each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we’re all after. Simply click here to discover how to learn more about these strategies.

View the “Social Security secrets” »

Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Vanguard S&P 500 ETF. The Motley Fool has a disclosure policy.

benzinga.com

benzinga.com fool.com

fool.com