In November, more than 51 million retired-worker beneficiaries brought home an average Social Security check of $1,925.46. Though this is a relatively modest payout from America’s leading social program, it’s a necessity that helps an overwhelming majority of retirees cover their expenses.

Since 2002, national pollster Gallup has surveyed retirees annually to decipher how important the income they receive from Social Security is. For 23 years, between 80% and 90% of respondents have noted that their Social Security benefit is a “major” or “minor” income source. Put another way, it’s not income that most aging Americans could live without.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Despite its undeniable importance to the financial well-being of seniors, Social Security’s own foundation has begun crumbling. Though the program is in no danger of going bankrupt or becoming insolvent, the trajectory of the current payout schedule, including cost-of-living adjustments (COLAs), is in question.

Strengthening Social Security for current and future generations will require action from elected officials — and this includes President-elect Donald Trump.

Former President and President-elect Donald Trump giving remarks. Image source: Official White House Photo by Joyce N. Boghosian.

Sweeping Social Security benefit cuts may be in the cards by 2033

In each of the last 85 years, the Social Security Board of Trustees has released a report that analyzes the financial health of Social Security. It traces where each dollar in income is generated, as well as lays out where those dollars end up.

Perhaps more importantly, the Trustees Report relies on changes in fiscal and monetary policy, as well as various demographic changes, to predict how financially sound this leading social program will be in the future. For four decades, the Trustees Report has warned that Social Security’s income collection in the 75 years following the release of a report would be insufficient to cover outlays — “outlays” primarily being benefits, and to a far lesser extent the fees used by the Social Security Administration to oversee the program.

Based on the 2024 Trustees Report, Social Security is contending with an unfunded obligation shortfall of $23.2 trillion through 2098.

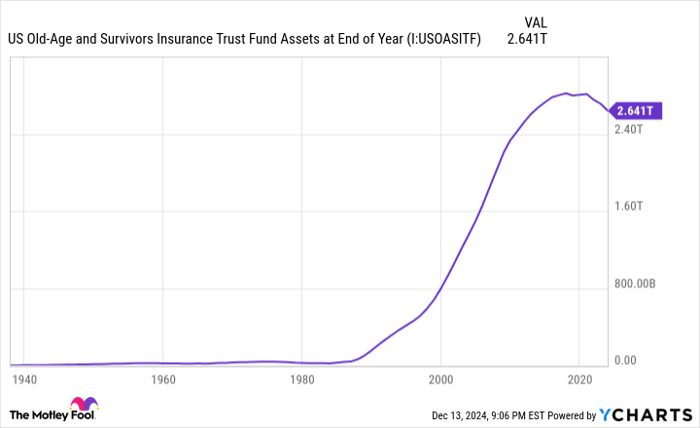

The more front-and-center concern is the program’s asset reserves. The Old-Age and Survivors Insurance Trust Fund (OASI), which is responsible for paying benefits to retired workers and survivors of deceased workers, is forecast to exhaust its roughly $2.64 trillion in asset reserves by 2033.

If the OASI’s asset reserves are depleted in nine years, as forecast, sweeping benefit cuts of up to 21% may be necessary to support continuous payouts, including annual COLAs, through 2098 without the need for any further reductions.

The OASI’s asset reserves are forecast to be depleted by 2033. US Old-Age and Survivors Insurance Trust Fund Assets at End of Year data by YCharts.

President-elect Donald Trump wants to change Social Security

While most lawmakers tend to avoid proposing changes to Social Security, presidential candidates don’t have this luxury. Despite previously aiming to steer clear of Social Security policy proposals, Trump did suggest making a major change to America’s leading retirement program while on the campaign trail.

In July, the now-president-elect posted on his social media platform (Truth Social) that “Seniors should not pay tax on Social Security.”

Trump’s proposal to eliminate the taxation of Social Security benefits would almost certainly be met with thunderous applause from the populace. In an informal poll conducted by nonpartisan senior advocacy group The Senior Citizens League, more than 90% of respondents believe Social Security benefits shouldn’t be taxable income.

In 1983, with Social Security’s asset reserves running dangerously low, Congress passed and then-President Ronald Reagan signed the Social Security Amendments of 1983 into law. This is the last major bipartisan overhaul of Social Security, and it, among other things, introduced the taxation of benefits to raise additional revenue.

Beginning in 1984, up to 50% of benefits could be exposed to the federal tax rate if provisional income — adjusted gross income + tax-free interest + one-half benefits — topped $25,000 for a single filer or $32,000 for couples filing jointly. In 1993, the Clinton administration added a second tax tier allowing up to 85% of benefits to be taxed if provisional income surpasses $34,000 for single filers or $44,000 for couples filing jointly.

The primary gripe is that these income thresholds have never been adjusted for inflation. As cost-of-living adjustments have pushed benefits nominally higher over time, it’s increased the number of seniors exposed to the taxation of benefits.

If Trump’s proposal were to become law, in the neighborhood of half of all beneficiaries would no longer owe federal tax on some portion of their Social Security check.

Image source: Getty Images.

History weighs in: Will Donald Trump’s Social Security proposal become law?

However, there’s a big difference on Capitol Hill between a proposal and a proposal becoming law. If history tells us anything, Trump has virtually no chance of enacting changes to Social Security while in office.

The first problem the incoming president will encounter is the lack of necessary votes to amend Social Security in the upper house of Congress. Amending Social Security requires 60 votes in the Senate, and the last time either party held a supermajority (60 seats) in the upper house was in 1979. Even if every GOP senator of the incoming Congress were to vote in favor of Trump’s proposal, he would still need seven Democrats on board to amend the program — and this simply won’t happen.

The other issue for President-elect Trump is that the change he wants to make to Social Security would actually worsen its financial health. The Trustees Report estimates that taxing benefits will generate just shy of $944 billion in cumulative income for Social Security between 2024 and 2033. Without this income, it would speed up the OASI’s asset reserve exhaustion date and potentially expedite the need for sweeping benefit cuts.

These unintended consequences make it highly unlikely that even members of his own party would vote in favor of these changes.

Although President-elect Donald Trump is highly unlikely to change Social Security, history does tell us that lawmakers have a knack for resolving crises with America’s leading retirement program in the eleventh hour.

As noted, lawmakers came to Social Security’s rescue in 1983 by raising revenue (introducing the taxation of benefits and gradually increasing the payroll tax) and reducing outlays (gradually raising the full retirement age). Both parties tend to find common ground when time is of the essence.

But with an estimated nine years to go before the OASI exhausts its asset reserves, we’re not in that critical eleventh hour just yet. While it would be great if lawmakers would be proactive instead of reactive, historic precedent suggests the Capitol Hill stalemate regarding Social Security will continue during Trump’s second term.

The $22,924 Social Security bonus most retirees completely overlook

If you’re like most Americans, you’re a few years (or more) behind on your retirement savings. But a handful of little-known “Social Security secrets” could help ensure a boost in your retirement income. For example: one easy trick could pay you as much as $22,924 more… each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we’re all after. Simply click here to discover how to learn more about these strategies.

View the “Social Security secrets” »

The Motley Fool has a disclosure policy.

benzinga.com

benzinga.com retire.ly

retire.ly marketbeat.com

marketbeat.com