Regardless of whether you’re just entering the labor force or have hung up your work coat for good, Social Security income is likely to play a key role in your financial stability during retirement.

For the last 23 years, national pollster Gallup has surveyed retirees to determine how reliant they are on the monthly Social Security income they receive. Between 80% and 90% of respondents, including 88% in April 2024, noted their Social Security income is necessary, in some capacity, to cover their expenses.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Unfortunately, this critical program to tens of millions of Americans has seen its own financial foundation weaken over many decades. Based on the latest estimates, sweeping Social Security benefit cuts may be just eight years away.

Image source: Getty Images.

Social Security benefit cuts may be needed by 2033

Ever since the first retired-worker benefit check was mailed in January 1940, the Social Security Board of Trustees has released an annual report that offers the public an under-the-hood look at how the program generates every dollar in income, as well as documents where those dollars end up.

What’s arguably more important about the annual Trustees Report is the forward-looking projections, which take into account a myriad of factors, such as changes to fiscal and monetary policy, along with demographic shifts, to estimate how financially sound America’s leading retirement program is over the long term — i.e., the 75 years following the release of a report.

Over the last 40 years, every Trustees Report has pointed to the program having a long-term funding obligation shortfall. In plain English, not enough income will be brought in over 75 years to cover outlays, such as benefits including cost-of-living adjustments (COLAs), and, to a lesser degree, the cost to operate the Social Security program.

This long-term cash shortfall has been growing for decades and reached $23.2 trillion in 2024 — but it isn’t the most immediate concern.

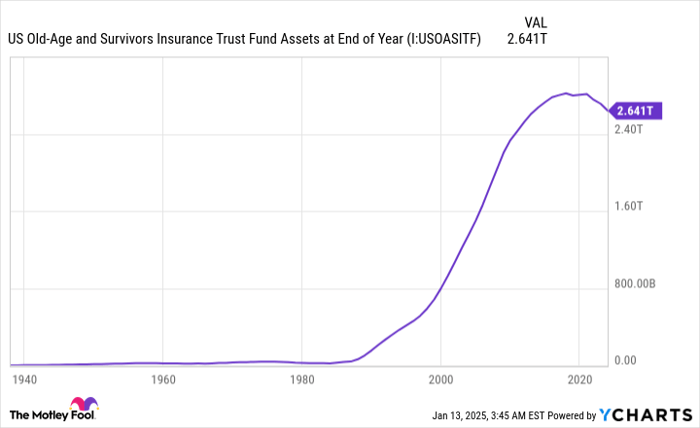

The 2024 Trustees Report also estimates the Old-Age and Survivors Insurance Trust Fund (OASI) will deplete its asset reserves by 2033. The OASI is responsible for dishing out payments to retired workers and survivor beneficiaries each month, and its “asset reserves” represent the excess income collected since inception that’s invested in special-issue government bonds, as required by law.

At the end of 2023, the OASI had $2.641 trillion in reserves that were invested in interest-bearing securities. By 2033, this excess income is expected to be exhausted. If the OASI’s asset reserves are depleted, retired workers and survivor beneficiaries would see their monthly Social Security checks reduced by up to 21%.

If there’s a silver lining here, it’s that Social Security is in no danger of going bankrupt or failing to be there for you when you retire. However, the continuity of the existing payout schedule, including annual COLAs, is very much in danger of being disrupted in just eight years.

The Trustees expect the OASI’s asset reserves to be depleted by 2033. US Old-Age and Survivors Insurance Trust Fund Assets at End of Year data by YCharts.

Point the finger of blame at demographic shifts

If you’re wondering how Social Security’s long-term financial health deteriorated, look no further than a multitude of demographics shifts.

For example, the U.S. birth rate is at a historic low and has declined by 17% since 2007. Though a persistent decline in births doesn’t have an immediate impact on Social Security, it’s expected to weigh down the worker-to-beneficiary ratio over the next 10 to 20 years. This comes atop the ongoing retirement of baby boomers, which is also lowering the worker-to-beneficiary ratio.

Rising income inequality is another issue that can’t be swept under the rug. In 2025, all earned income (wages and salary, but not investment income) between $0.01 and $176,100 is subject to the 12.4% payroll tax, which is the primary funding mechanism for Social Security.

In the mid-1980s, around 90% of all earned income was subject to the payroll tax. But as of 2023, only 83% of earned income was subject to this tax. Long story short, wage growth for high earners is outpacing the near-annual increase in the payroll tax cap, leading to more wages and salary “escaping” the payroll tax over time.

Immigration also deserves its fair share of the blame — but not for the reason you might think. Social Security relies on a steady influx of legal net migration into the U.S. to help generate payroll tax income. Most legal migrants are young, which means they’ll spend decades in the labor force contributing to Social Security before receiving a retired-worker benefit of their own decades down the line.

However, the net migration rate into the U.S. declined for 25 consecutive years from 1998 through 2023. This 58% peak-to-trough drop in the net migration rate is widening Social Security’s funding obligation shortfall.

And for those curious, Congress didn’t steal from Social Security’s trust funds, nor are undocumented workers receiving traditional Social Security benefits. These two common online scapegoats aren’t why Social Security is in trouble.

Image source: Getty Images.

“Fixes” are available, but there’s no simple solution

Current and future retirees are counting on their elected officials to put their heads together and strengthen a program that’s become foundational for most Americans. While lawmakers in Congress recognize the issue at hand, getting a solution in place is easier said than done.

One of the biggest challenges is that Democrats and Republicans have approached “fixing” Social Security from opposite ends of the spectrum. Democrats prefer raising additional revenue by increasing payroll taxes on high earners, while Republicans favor reducing long-term outlays by gradually raising the full retirement age.

The problem with these core proposals is there’s no support beyond party lines. Democrats are adamantly against any reform that reduces benefits, and raising the full retirement age would require future generations of beneficiaries to wait longer to receive 100% of their monthly payout. Meanwhile, Republicans are staunchly opposed to legislation that targets high earners.

The other dilemma is that 60 votes are needed in the upper house of Congress to amend the Social Security Act. The last time either party held a supermajority of seats (60) in the Senate was 1979. This means any meaningful reform would require bipartisan support, which has been tough to come by.

But if there’s one positive to take away from this discussion, it’s that lawmakers have previously come through for Social Security in the 11th hour. For instance, with the program’s asset reserves running dangerously low in 1983, a bipartisan Congress passed and then-President Ronald Reagan signed the Amendments of 1983 into law.

Strengthening Social Security can be done, but getting from Point A to B will likely prove challenging over the next eight years.

The $22,924 Social Security bonus most retirees completely overlook

If you’re like most Americans, you’re a few years (or more) behind on your retirement savings. But a handful of little-known “Social Security secrets” could help ensure a boost in your retirement income. For example: one easy trick could pay you as much as $22,924 more… each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we’re all after. Simply click here to discover how to learn more about these strategies.

View the “Social Security secrets” »

The Motley Fool has a disclosure policy.

benzinga.com

benzinga.com fool.com

fool.com