Millions of older adults lean on Social Security heavily in retirement, and if you’re married, that could provide an extra boost in the form of spousal benefits.

You can collect up to 50% of your partner’s full benefit amount in spousal benefits, and the average spouse of a retired worker collects just over $900 per month, according to 2024 data from the Social Security Administration.

But if the unthinkable happens and your spouse passes away, that could affect your benefit amount. While nobody wants to plan for such an event, it can be helpful to have an idea of how a spouse’s passing could affect your financial future.

Image source: Getty Images.

Your benefits could change after a spouse’s death

If you’re receiving spousal benefits based on your partner’s work record, you’ll no longer qualify if your spouse passes away. However, you could instead be eligible for survivors benefits.

Survivors benefits are primarily available to spouses, but sometimes other family members — including divorced partners, parents, and children — can also qualify if they were financially dependent on the deceased person.

You generally need to be at least 60 years old to begin taking survivors benefits, but disabled spouses could file as early as age 50. If you’re caring for the deceased person’s child and that child is either disabled or under age 16, you may qualify for survivors benefits at any age.

Finally, if you remarry after a spouse’s death, you’ll only be eligible for survivors benefits if you’re age 60 or older (or age 50 or older if you’re disabled). Remarrying before that age will disqualify you from survivors benefits, but you could potentially collect spousal benefits on your current partner’s record starting at age 62.

How much can you collect in survivors benefits?

Your benefit amount will depend on a few factors, including your relation to the deceased person and your age.

Spouses can collect up to 100% of their partner’s benefit once they pass away, but to receive that full amount, you’ll need to wait until your full retirement age to file.

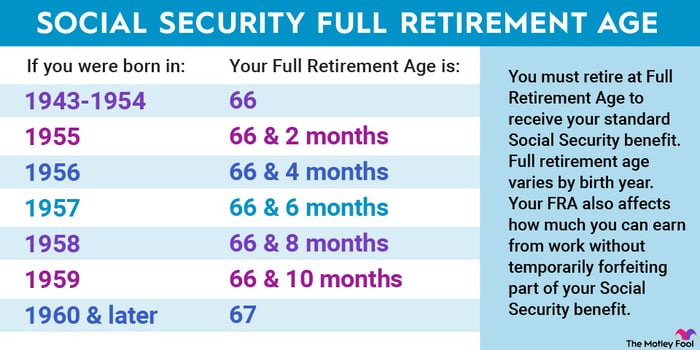

Your full retirement age is between ages 66 and 67 depending on your birth year, and if you file earlier than that, you’ll receive a reduced payment. By filing at age 60, you’ll receive 71.5% of your spouse’s benefit.

Image source: The Motley Fool.

Also, unlike with standard retirement benefits, delaying claiming past your full retirement age won’t earn you larger checks. In any case, the highest amount you can receive is 100% of your spouse’s benefit.

Other family members, such as parents and children who were financially dependent on the deceased person, can sometimes receive survivors benefits, too. However, there is a limit on how much a family can claim based on a deceased member’s benefit, called the family maximum. In some cases, your benefit could be reduced to stay under the maximum.

What if you’re already receiving retirement benefits?

One other important factor to keep in mind is that if you’re collecting retirement benefits based on your own work history, you’ll only receive survivors benefits if that payment is higher than what you’re already receiving.

So, for example, say you’re currently receiving $2,000 per month in retirement benefits while your spouse receives $1,500 per month. If your spouse passes away, your maximum survivors benefit would be $1,500 per month. However, since your retirement benefit is already higher than that, you won’t receive anything in survivors benefits.

If the roles were reversed and you were receiving $1,500 per month while your spouse earned $2,000 per month, you’d receive a maximum benefit of $2,000 per month at your full retirement age. In other words, you’ll only collect the higher of the two amounts — not both.

Survivors benefits can be complex, but they can also be a lifeline in retirement if your spouse unfortunately passes away. By understanding at least the basics of how they work and who qualifies, you can better prepare for whatever your future throws at you.

The $22,924 Social Security bonus most retirees completely overlook

If you’re like most Americans, you’re a few years (or more) behind on your retirement savings. But a handful of little-known “Social Security secrets” could help ensure a boost in your retirement income. For example: one easy trick could pay you as much as $22,924 more… each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we’re all after. Simply click here to discover how to learn more about these strategies.

View the “Social Security secrets” »

The Motley Fool has a disclosure policy.

benzinga.com

benzinga.com fool.com

fool.com