In October, more than 51 million retired-worker beneficiaries took home a check averaging $1,924.35. While this is a relatively modest monthly payout, surveys show that it’s a necessity to support the financial needs of an aging workforce.

Over the last 23 years, Gallup has polled retirees to gauge their reliance on Social Security income to make ends meet. In all 23 surveys, 80% to 90% of retirees have noted that their monthly Social Security check is a “major” or “minor” income source. In other words, aging Americans would struggle to make ends meet without this social program.

Unfortunately, the foundation for this nearly 90-year-old program is crumbling. While Social Security is in no danger of going bankrupt or becoming insolvent, it’s becoming harder to ignore the program’s widening long-term funding deficit and rapidly approaching forecast of benefit cuts.

Image source: Getty Images.

A $23.2 trillion (and growing) long-term funding deficit awaits

Ever since the Social Security Administration (SSA) mailed out the very first retired-worker benefit check in January 1940, the Social Security Board of Trustees has issued an annual report detailing the financial health of the program. This report tracks the income the SSA receives and disburses and forecasts the future health of Social Security by taking into account demographic changes, as well as shifts in fiscal and monetary policy.

When the Social Security Amendments of 1983 were signed into law, the program’s foundation appeared secure. This last major bipartisan overhaul raised revenue by introducing the (now-hated) taxation of benefits and gradually increased the 12.4% payroll tax on earned income — this includes wages and salary, but not investment income. It also modestly reduced outlays by gradually increasing the full retirement age over four decades.

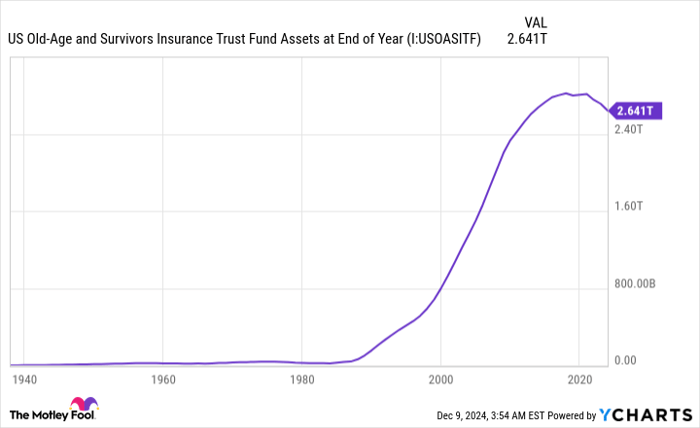

Between 1983 and 2020, the Old-Age and Survivors Insurance Trust Fund (OASI) and Disability Insurance Trust Fund (DI) saw their combined asset reserves climb from a modest $24.9 billion to almost $2.91 trillion.

Despite this growth in the OASI’s and DI’s combined asset reserves, the long-term funding obligation shortfall forecast for America’s leading retirement program has been steadily rising since 1985. In short, the Trustees have been predicting that income collection in the 75 years following the release of a report would be insufficient to cover outlays (benefits plus administrative expenses to run the program), including cost-of-living adjustments (COLAs).

In 2023, Social Security’s long-term funding deficit stood at $22.4 trillion. But as of the 2024 Trustees Report, this shortfall has widened by another $800 billion to $23.2 trillion.

Sweeping benefit cuts of up to 21% may be on the docket by 2033

Although $23.2 trillion is a worrisome number, it’s not the most immediate threat to Social Security.

In 2020, the OASI — the fund that doles out payments to retired workers and survivor beneficiaries — saw its asset reserves climb by $7.4 billion to a peak of about $2.812 trillion. Over the last three years, the OASI’s asset reserves have declined by about $170 billion, in aggregate.

US Old-Age and Survivors Insurance Trust Fund Assets at End of Year data by YCharts.

Based on estimates from the 2024 Trustees Report, this $2.64 trillion in remaining excess cash built up since inception, which is currently invested by law in special-issue, interest-bearing government bonds, is projected to be gone by 2033.

Once again, there’s no chance of bankruptcy or insolvency for Social Security, thanks to the payroll tax on wages and salaries accounting for the lion’s share of the program’s income. But the existing payout schedule, including COLAs, is very much in question.

If the OASI’s asset reserves are depleted, sweeping benefit cuts of 21% may be necessary by 2033 to sustain payouts through 2098.

Demographic changes are to blame for most of Social Security’s shortcomings

Now that you have a better understanding of where Social Security stands financially, let’s tackle the all-important question: “How did we get here?”

What I can say with absolute certainty is that social media message board claims of “Congress stealing from Social Security” and “benefits being given to undocumented migrants” are completely false. While there’s no singular reason for Social Security’s financial woes, there are a confluence of factors tied to ongoing demographic changes that have put the program in the position it is today.

Some of these changes you’re undoubtedly familiar with. For instance, the ongoing retirement of baby boomers is weighing down the worker-to-beneficiary ratio. Additionally, retirees are living considerably longer now than when the first benefit check was mailed out in 1940. Social Security simply wasn’t designed to pay retired-worker benefits for decades.

But the bigger problem just might be the demographic changes that are under the radar. For example, the U.S. birth rate has hit an all-time low, which is likely to pressure an already challenged worker-to-beneficiary ratio over the next two decades.

Income inequality can’t be swept under the rug, either. Since the mid-1980s, a higher percentage of earned income has escaped being applicable to the 12.4% payroll tax.

Lastly, immigration is an issue — but again, not for the reason attributed on some social media message boards. Legal migration into the U.S. has declined for 25 consecutive years, which is a problem, given that legal migrants tend to be younger and spend decades in the labor force.

Image source: Getty Images.

Strengthening Social Security will require bipartisan cooperation

If there’s a silver lining for seniors, it’s that Social Security can be fixed. Lawmakers from both parties came together in 1983 to pass the aforementioned legislation that raised additional revenue and modestly reduced outlays for future generations of workers.

But therein lies the problem. For starters, amending the Social Security Act will require 60 votes in the Senate. The last time either party held a supermajority in the upper house of Congress was 1979. This means any legislation designed to reform Social Security will require some assistance from the opposing party.

Ideologically, Democrats and Republicans have approached their respective “fixes” for Social Security from opposite ends of the spectrum, leaving little to no room for middle-ground solutions.

Democrats have traditionally favored raising or removing the payroll tax earnings cap to collect additional revenue from high earners. By comparison, Republicans prefer gradually increasing the full retirement age, which would lower outlays for future generations of workers.

Democrats in Congress have been clear that they won’t vote in favor of proposals that would reduce benefits. Conversely, Republican lawmakers are adamantly against proposals that specifically target increasing taxation on high earners. Thus, we have a stalemate.

Although history does show that lawmakers will act to preserve Social Security payouts, this action tends to come during the proverbial eleventh hour. This looks to be the trajectory we are once again on.

The $22,924 Social Security bonus most retirees completely overlook

If you’re like most Americans, you’re a few years (or more) behind on your retirement savings. But a handful of little-known “Social Security secrets” could help ensure a boost in your retirement income. For example: one easy trick could pay you as much as $22,924 more… each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we’re all after. Simply click here to discover how to learn more about these strategies.

View the “Social Security secrets” »

The Motley Fool has a disclosure policy.

fool.com

fool.com benzinga.com

benzinga.com theblock.co

theblock.co