For most retired Americans, Social Security is more than just a check. It represents an indispensable lifeline that shapes their financial foundation.

Over the last 23 years, national pollster Gallup has been conducting annual surveys to gauge how reliant retirees are on the income they receive from Social Security. Consistently, between 80% and 90% of retirees have responded that it’s a “major” or “minor” income source, including 88% in 2024. Put another way, roughly nine out of 10 retirees would struggle to make ends meet without this vital program.

With the above being said, it should come as no surprise that the cost-of-living adjustment (COLA) reveal is the most-awaited announcement of the year for the program’s more than 68 million recipients.

Although beneficiaries missed out on a history-making moment with the 2025 COLA, another above-average increase is set to lift Social Security checks in the upcoming year.

Image source: Getty Images.

What is Social Security’s COLA and how is it calculated?

Before diving into the meat-and-potatoes of the changes the Social Security Administration (SSA) announced last week, it’s important to first understand what the cost-of-living adjustment is and how it’s calculated.

The purpose of Social Security’s COLA is very simple: to keep benefits on par with the prevailing rate of inflation.

As an example, if the cumulative price of a large basket of goods and services regularly purchased by Social Security beneficiaries increases in value by 4%, Social Security checks should, ideally, rise by a matching 4% to ensure that recipients don’t lose buying power.

In Social Security’s early days, there was no set plan for addressing the impact of inflation (rising prices) on benefits. No COLAs were passed along during the entirety of the 1940s, and only 11 COLAs were administered by special sessions of Congress from 1950 through 1974.

Starting in 1975, the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) was tasked with measuring annual price changes for America’s top retirement program. The beauty of the CPI-W is that it has more than 200 weighted price categories, which allows this inflationary index to be whittled down to a single figure each month. This makes it incredibly easy to determine if the price for a broad basket of goods and services is rising (inflation) or falling (deflation) on a year-over-year basis.

Although the CPI-W is reported monthly, only the trailing-12-month readings ending in July, August, and September (i.e., the third quarter) are used when calculating Social Security’s COLA. If the average CPI-W reading for the third quarter (Q3) in the current year is higher than the comparable Q3 reading from the previous year, the collective price for goods and services has increased and Social Security checks are poised to rise.

Social Security’s COLA is simply the year-over-year percentage difference in these average Q3 CPI-W readings, rounded to the nearest tenth of a percent.

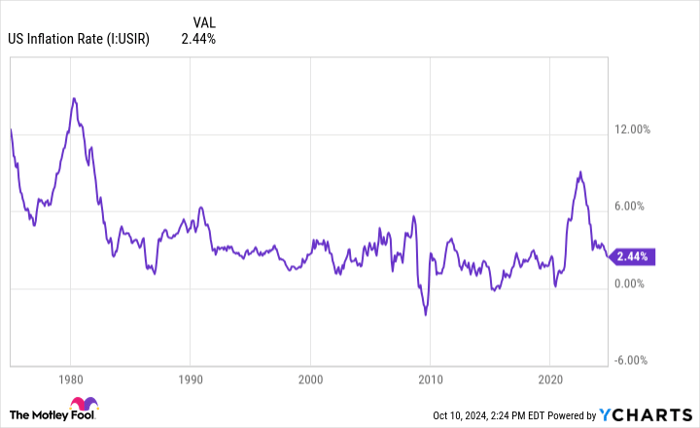

An uptick in the prevailing rate of inflation has led to four consecutive above-average COLAs. US Inflation Rate data by YCharts.

Here’s how much average Social Security check is set to climb in 2025

Throughout much of the year, there was hope that Social Security’s 2025 cost-of-living adjustment would make history.

Following a decade that featured three years of deflation where no COLA was passed along (2010, 2011, and 2016), as well as the smallest positive COLA in history (0.3% in 2017), beneficiaries enjoyed respective benefit-check increases of 5.9% in 2022, 8.7% in 2023, and 3.2% in 2024.

If the 2025 COLA had somehow come in at 2.7%, it would have been the first time in 32 years that four consecutive increases reached this mark. Meanwhile, if the 2025 cost-of-living adjustment was 2.6%, it would be the first time in 28 years that it had hit this level in four straight years. Alas, neither history-making moment was meant to be.

When the SSA unveiled the 2025 COLA Fact Sheet on Oct. 10, it dialed in a 2.5% COLA for the upcoming year. Thankfully, this is still modestly above average, when compared to the average 2.3% COLA that’s been passed along since 2010.

But it’s one thing to talk about percentages and an entirely differently beast to discuss what these percentages mean in dollar terms for beneficiaries.

According to estimates from the SSA, the average Social Security check for the more than 51 million current retired-worker beneficiaries should climb from $1,927 per month to $1,976 per month come 2025, representing an increase of $49 per month in the new year.

The average monthly payout for workers with disabilities and survivor beneficiaries will also rise by 2.5%. For the nearly 7.3 million workers with disabilities, their average check will jump from an estimated $1,542 per month to $1,580 each month in 2025 — an extra $38 per month.

Meanwhile, the average Social Security benefit for the program’s 5.8 million survivor beneficiaries is on track to rise from an author estimated $1,513 per month to $1,551 monthly ($38/month extra) in the upcoming year.

Image source: Getty Images.

Social Security’s COLA often comes up short for retirees

While the headline figure for Social Security’s 2025 cost-of-living adjustment is appealing — a fourth consecutive year of an above-average COLA — the end result for retirees looks to be another mixed bag.

The clearest concern for retirees is that important costs are increasing at a pace that’s considerably higher than the 2.5% COLA they were just awarded for the upcoming year.

Compared to working-age Americans, seniors spend a disproportionately higher percentage of their monthly budget on shelter (the largest-weighted component in the CPI-W) and medical care services. The trailing-12-month rate of inflation for shelter is more than twice the 2025 COLA, while the rate of inflation for medical care services is modestly higher. What this data implies is that the buying power of a Social Security dollar will decline in 2025.

Unfortunately, this is nothing new for retirees. In May 2023, nonpartisan senior advocacy group The Senior Citizens League (TSCL) released a study that compared cumulative COLAs from January 2000 through February 2023 to price changes for a basket of dozens of goods and services regularly purchased by seniors over the same time frame. TSCL calculated that the purchasing power of a Social Security dollar had fallen by 36% for seniors.

A separate study from TSCL, which was released in July 2024, estimates the buying power of Social Security benefits has dropped by 20% just since 2010. Inherent flaws in the CPI-W make it highly unlikely that this persistent loss of purchasing power for retirees will reverse anytime soon.

Aged beneficiaries will also be without a prized silver lining in the new year.

In 2023, Medicare’s Part B premium declined for only the second time this century. Part B is the segment of Medicare that covers outpatient services, and this premium is often deducted from the checks of Social Security recipients aged 65 and older (i.e., the qualifying age for Medicare). A reduced Part B premium allowed beneficiaries to hang onto more of their record-breaking 8.7% COLA in 2023.

In 2025, Medicare’s Part B premium is forecast to rise by more than twice the rate of Social Security’s COLA. As a result, most aged beneficiaries will see some or all of their nominal-dollar increase gobbled up by a higher monthly Part B premium.

Even in years where an above-average COLA is passed along, retirees often get the short end of the stick.

The $22,924 Social Security bonus most retirees completely overlook

If you’re like most Americans, you’re a few years (or more) behind on your retirement savings. But a handful of little-known “Social Security secrets” could help ensure a boost in your retirement income. For example: one easy trick could pay you as much as $22,924 more… each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we’re all after. Simply click here to discover how to learn more about these strategies.

View the “Social Security secrets” »

The Motley Fool has a disclosure policy.

fool.com

fool.com marketbeat.com

marketbeat.com benzinga.com

benzinga.com accuweather.com

accuweather.com