The big day is right around the corner. On Thursday, Oct. 10, the Social Security Administration (SSA) will announce the highly anticipated cost-of-living adjustment (COLA) for 2025.

For most aging Americans, Social Security income is a necessity to make ends meet. The program is responsible for pulling 22.7 million people above the federal poverty line each year, including 16.5 million adults aged 65 and over, based on a study by the Center on Budget and Policy Priorities.

Furthermore, 23 years of annual polling by Gallup have shown that 80% to 90% of retirees lean on their Social Security check, to some degree, to cover their expenses.

Nothing is more important for Social Security’s more than 68 million beneficiaries than knowing how much they’ll be receiving each month in 2025. While Social Security’s 2025 COLA does offer promise, a perilous outcome also awaits most retirees.

Image source: Getty Images.

How is Social Security’s COLA calculated?

Social Security’s “COLA,” which you’ve probably been hearing about a lot lately, is the mechanism the SSA has at its disposal to keep benefits on par with inflation. In plainer English, it’s there to help ensure that beneficiaries don’t lose purchasing power over time.

For example, let’s say that a large basket of goods and services regularly purchased by retirees collectively increases in price by 3% from one year to the next. If Social Security benefits remained the same, retirees wouldn’t be able to buy the same amount of goods and services. Social Security’s COLA is an increase to benefits that’s passed along most years to keep pace with inflation (rising prices).

From the first mailed retired-worker benefit check in January 1940 through December 1974, there wasn’t a set standard for adjusting benefits. Special sessions of Congress arbitrarily approved 11 COLAs in this 35-year stretch, including the largest COLA on record — 77% in 1950.

Since 1975, the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) has been tasked with measuring price changes for America’s top retirement program. The CPI-W has more than 200 spending categories, all of which have their own unique percentage weightings. These weightings allow the CPI-W to be expressed as a single figure, which makes for easy-to-understand year-over-year comparisons and allows for annual COLAs to be passed along.

Interestingly, though, Social Security’s COLA calculation only uses the trailing 12-month (TTM) CPI-W readings ending in July, August, and September. While the other nine months of the year can offer clues as to whether prices are rising (inflation) or falling (deflation), only the third-quarter (Q3) TTM readings matter.

If the average Q3 CPI-W reading is higher than the same period from the previous year, prices have risen and Social Security checks are set to increase. The amount of this increase is equal to the year-over-year percentage difference in average Q3 CPI-W, rounded to the nearest tenth of a percent.

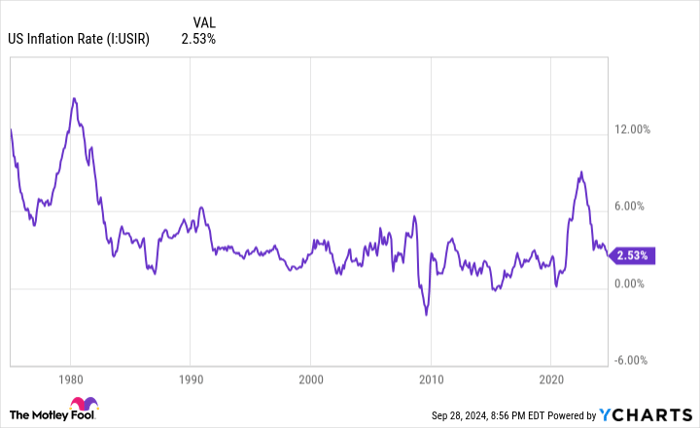

A big uptick in the prevailing rate of inflation sent COLAs soaring in recent years. U.S. Inflation Rate data by YCharts.

The 2025 cost-of-living adjustment offers promise

Throughout the 2010s, Social Security COLAs were mostly anemic. The only three years since 1975 where deflation occurred and no COLA was passed along were 2010, 2011, and 2016, and the smallest positive COLA on record (0.3%) took place in 2017.

However, beneficiaries have enjoyed a change of fortune over the last three years. A historic increase in U.S. money supply sent the prevailing rate of inflation to levels that haven’t been seen in four decades. Since Social Security’s COLA is a reflection of price changes, this led to well-above-average increases to Social Security checks. In 2022, 2023, and 2024, benefit checks rose by 5.9%, 8.7%, and 3.2%, respectively. The 8.7% hike in 2023 was the largest on a percentage basis since 1982.

Although 2025’s potentially history-making COLA looks to be off the table — it’s been 28 years since four consecutive cost-of-living adjustments came in at 2.6% or higher — a fourth straight year of an above-average payout boost is likely.

The Senior Citizens League (TSCL), a nonpartisan group that advocates about issues affecting seniors, is expecting a 2.5% COLA for 2025, based on data from the August inflation report.

Similarly, independent Social Security and Medicare policy analyst Mary Johnson, who recently retired from TSCL, has settled on a forecast of 2.5% for Social Security’s 2025 COLA.

Even though a 2.5% COLA would be the lowest in four years, it would still be above the 2.3% average increase beneficiaries have received over the previous 15 years. That’s promising news for the program’s more than 51 million retired workers.

To add to this point, the 2.5% prevailing rate of inflation on a TTM basis ending in August is the lowest since February 2021. If the rate of inflation for goods and services continues to decline into 2025, it’s possible retirees could see their Social Security dollar stretch further.

Image source: Getty Images.

Social Security’s 2025 COLA also presents a perilous scenario for most retirees

But not everything is promising about Social Security’s upcoming COLA announcement. Despite a fourth straight year of an above-average COLA, two factors are likely to result in seniors losing purchasing power, once again.

As I pointed out earlier, the CPI-W is comprised of more than 200 spending categories. However, some of these spending categories matter far more than others.

Compared to the typical working-age American, seniors spend a higher percentage of their monthly budget on shelter (the highest-weighted spending category in the CPI-W) and medical care services. As of the end of August 2024, shelter and medical care services inflation stood at 5.2% and 3.2%, respectively, on a TTM basis, per the Consumer Price Index for All Urban Consumers (CPI-U). Even though the prevailing rate of inflation is tapering, the costs that matter most to retirees aren’t coming down much, if at all.

To make matters worse, the CPI-W is designed to track the spending habits of “urban wage earners and clerical workers.” These are predominantly working-age Americans who aren’t receiving a Social Security benefit at the moment — yet their spending habits are dictating Social Security’s COLA.

The other prominent issue is that the Medicare Part B premium is set to increase by an estimated 5.9% for a second consecutive year. Part B is the segment of Medicare responsible for outpatient services, and this premium is commonly deducted from Social Security benefit checks for Medicare enrollees.

If the Medicare Trustees Report’s forecast is correct and the Part B premium rises to $185 per month in 2025, most aged Social Security beneficiaries will see some or all of their COLA diverted to cover this increase.

In spite of another promising cost-of-living adjustment, retirees are likely going to see the purchasing power of their Social Security dollar decline.

The $22,924 Social Security bonus most retirees completely overlook

If you’re like most Americans, you’re a few years (or more) behind on your retirement savings. But a handful of little-known “Social Security secrets” could help ensure a boost in your retirement income. For example: one easy trick could pay you as much as $22,924 more… each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we’re all after. Simply click here to discover how to learn more about these strategies.

View the “Social Security secrets” »

The Motley Fool has a disclosure policy.

benzinga.com

benzinga.com fool.com

fool.com