Determining when to take Social Security is an important life decision, and it’s smart to begin thinking about it well before retirement. Your claiming age will have a direct impact on your monthly benefit, and the sooner you make this decision, the better you’ll be able to plan.

You have plenty of choices when it comes to the age you file for benefits. Age 62 is the earliest you can file, and while there’s technically no cut-off after that, you’ll stop seeing benefit increases after age 70. For most people, then, there’s no reason to delay claiming past that age.

Image source: Getty Images.

Whether you file at 62, 70, or sometime in between, it will have a massive effect on your monthly checks. Here’s what the average payments look like at all ages between 62 and 70, as well as what the data says about the best time to claim.

The average Social Security benefit by age

Before we dive into the numbers, it’s a good idea to look at how your benefit will be calculated.

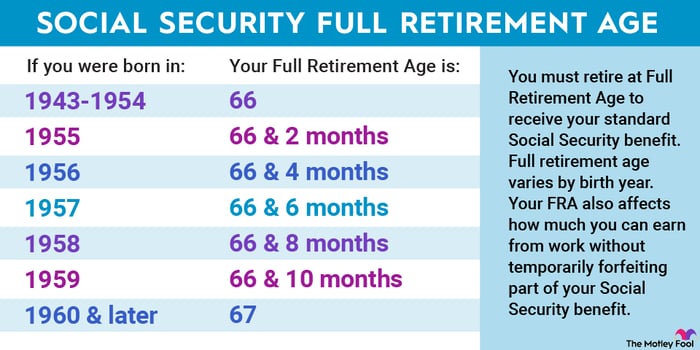

To receive the full benefit you’re entitled to based on your earnings and work history, you’ll need to file at your full retirement age (FRA). This age will vary by birth year, but it’s 67 years old for everyone born in 1960 or later.

Image source: The Motley Fool.

Filing any earlier than your FRA will permanently reduce your monthly benefit. If you have an FRA of 67 and claim at 62, your payments will be cut by 30% for life. But if you delay benefits past your FRA (up to age 70), you’ll collect a bonus of between 24% and 32% per month, depending on your birth year.

These adjustments can add up to hundreds of dollars per month, and the difference can be life-changing for some people. In fact, the average retired worker collects a whopping $740 more per month at age 70 compared to age 62, according to December 2023 data from the Social Security Administration.

| Age | Average Monthly Benefit Among Retired Workers |

|---|---|

| 62 | $1,298 |

| 63 | $1,339 |

| 64 | $1,460 |

| 65 | $1,563 |

| 66 | $1,740 |

| 67 | $1,884 |

| 68 | $1,948 |

| 69 | $1,945 |

| 70 | $2,038 |

Source: Social Security Administration. Table by author.

Despite the potential to earn far more at age 70 than at earlier ages, it’s not the most popular time to claim. Less than 10% of older adults wait until age 70 to file, according to data from the Social Security Administration, while nearly one-quarter file at age 62.

While there’s not necessarily a right or wrong time to take Social Security, it is important to consider how the decision will affect your long-term finances. And for some retirees, some ages are better than others.

The best time to take benefits, according to data

In a 2022 study by the National Bureau of Economic Research, analysts examined retirees’ claiming ages and their lifetime income to determine how older adults could best optimize their Social Security decisions.

They found that for 91.6% of study participants, claiming at age 70 was the ideal choice to maximize their lifetime benefit amount. Furthermore, a whopping 99.4% of older adults could optimize their benefits by waiting until after age 65 to begin claiming.

The right decision can seriously pay off, too. The researchers found that study participants aged 45 to 62 could see a median lifetime benefit increase of $225,944 by filing at the ideal age, and across households of all ages, the median lifetime increase was $158,069.

| Age | Median Lifetime Benefit Increase by Filing at Ideal Age |

|---|---|

| All Households | $158,069 |

| 21 to 44 | $259,997 |

| 45 to 62 | $225,944 |

| 63 to 69 | $117,090 |

Source: National Bureau of Economic Research. Table by author.

Keep in mind, though, that finances aren’t everything when it comes to choosing when to file. Waiting until 70 could maximize your lifetime income, but if you’re battling health issues or have other reason to believe you may not live well into your 70s or beyond, it may not make much sense to delay benefits.

Also, sometimes it just comes down to personal preference. Maybe you have plenty of savings and want to retire and take benefits at 62, and you’re OK with making some financial sacrifices. As long as you’re aware of how your decision will affect your benefits, there’s nothing wrong with that strategy.

How much you collect from Social Security each month will depend on when you claim, and that’s a highly personal choice unique to your situation. By considering all of your options and weighing them carefully, you can ensure you’re as informed as possible before making your decision.

The $22,924 Social Security bonus most retirees completely overlook

If you’re like most Americans, you’re a few years (or more) behind on your retirement savings. But a handful of little-known “Social Security secrets” could help ensure a boost in your retirement income. For example: one easy trick could pay you as much as $22,924 more… each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we’re all after. Simply click here to discover how to learn more about these strategies.

View the “Social Security secrets” »

The Motley Fool has a disclosure policy.

marketbeat.com

marketbeat.com benzinga.com

benzinga.com fool.com

fool.com