The most important day of the year is nearly here for Social Security’s more than 68 million beneficiaries. In just five days, on Oct. 10, the Social Security Administration (SSA) will unveil the much-anticipated cost-of-living adjustment (COLA), which will allow beneficiaries to calculate how much they’ll receive per month next year.

Based on more than two decades of annual surveys from national pollster Gallup, between 80% and 90% of retirees rely on their monthly Social Security check, in some capacity, to make ends meet. Thus, having clarity on how big their check will be in 2025 is of the utmost importance to most beneficiaries.

While the 2025 COLA offers a partial silver lining for the program’s recipients, the future isn’t so bright.

Image source: Getty Images.

Social Security’s COLA serves a key purpose for beneficiaries

The annually announced cost-of-living adjustment is the device on the SSA’s proverbial tool belt that is tasked with ensuring Social Security income doesn’t lose buying power over time.

The price for the vast majority of the products and services we buy is going to change, with most of these goods and services becoming nominally costlier over long periods. Ideally, Social Security benefits are going to increase by a percentage identical to the prevailing rate of inflation, which should — on paper — allow the program’s beneficiaries to purchase the same amount of goods and services year after year. This “increase” is the COLA.

In the early existence of America’s top retirement program, there were no indexes that governed cost-of-living adjustments. No COLAs were administered during the entirety of the 1940s, and only 11 increases were passed along by special sessions of Congress from 1950 through 1974.

Beginning in 1975, the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) was slotted in as Social Security’s inflationary index that would allow for annual COLA calculations. The key with the CPI-W is that it has north of 200 spending categories, each of which has its own unique weighting.

These percentage weightings are what allow the index to be whittled down to a single figure each month, which makes for incredibly easy year-over-year comparisons to determine if prices are, collectively, rising (inflation) or falling (deflation).

Although the U.S. Bureau of Labor Statistics (BLS) reports the CPI-W monthly, Social Security’s COLA calculation only factors in the trailing-12-month readings for the months ending in July, August, and September (i.e., the third quarter). If you’ve ever wondered why the COLA is announced during the second week of October every year, it’s because the BLS September inflation report is the final puzzle piece needed for the calculation, and it’s reported during the second week of October.

If the average third-quarter CPI-W reading in the current year is higher than the comparable period of the previous year, the collective price for goods and services has risen and beneficiaries will see their Social Security checks rise in the upcoming year. The year-over-year percentage difference in these average CPI-W readings, rounded to the nearest tenth of a percent, determines the COLA.

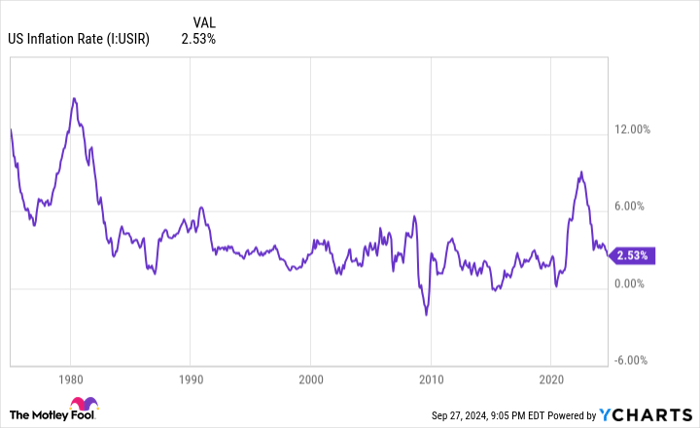

An elevated rate of inflation has led to three years of above-average COLAs (2022-2024). US inflation rate data by YCharts.

The 2025 cost-of-living adjustment should be meaningful for a fourth straight year

Although estimates for Social Security’s 2025 COLA began on opposite ends of the spectrum, they have now converged and are in agreement on what to expect in the upcoming year.

In mid-January this year, the nonpartisan senior advocacy group The Senior Citizens League (TSCL) offered its very early forecast of a menial 1.4% cost-of-living adjustment for 2025. But following eight months of inflation data, TSCL has settled on a 2025 COLA estimate of 2.5%.

Meanwhile, independent Social Security and Medicare policy analyst Mary Johnson, who recently retired from TSCL, had been counting on a more robust 2025 COLA of up to 3.2% following the April inflation report from the BLS. But after each successive report, Johnson’s forecast has declined and now also sits at 2.5%.

Even though a 2.5% COLA would mark the smallest increase beneficiaries have received since 2021 — the 2022, 2023, and 2024 COLAs came in at 5.9%, 8.7%, and 3.2%, respectively — it still represents an above-average boost to benefits when compared to the previous 15 years.

Since 2010, we’ve witnessed three years where deflation occurred and no cost-of-living adjustment was given (2010, 2011, and 2016), as well as the smallest positive COLA on record (0.3% in 2017). All told, 10 out of the last 15 years have featured COLAs of 2% or lower, with an average COLA of 2.3% over this span. If TSCL’s and Johnson’s forecasts are accurate, a 2.5% COLA in 2025 would be modestly above average.

For the average retired workers, a 2.5% COLA would be expected to increase their monthly Social Security check by $48 in 2025. As for workers with disabilities and for survivor beneficiaries, the average check would rise by $39 per month and $38 per month, respectively, next year.

Image source: Getty Images.

Though it’s very early, Social Security’s 2026 COLA could be historically low

While it’s generally good news that beneficiaries are set to receive another meaningful cost-of-living adjustment come January, the same can’t be said about 2026.

Let me preface this discussion by plainly stating that a lot can happen over the next 12 months. A quick glance at the changes we’ve witnessed in the U.S. inflation rate over the last half-century shows that projections are quite fluid.

Nevertheless, clear-as-day clues suggest Social Security’s 2026 COLA could be historically low — one of the lowest positive COLAs on record, if not the fourth year since 1975 where no COLA is passed along.

The CPI-W is designed to track the prevailing rate of inflation. If the price for various goods and services declines, Social Security’s COLA would be expected to shrink or head to zero. When deflation occurs, beneficiaries receive no COLA.

One of the likeliest catalysts behind a decline in the price of goods and services is a U.S. recession. At the moment, a few predictive metrics, each of which offers a lengthy history of accurately predicting downturns in the U.S. economy, are foreshadowing weakness in the coming quarters. These data points include:

- The longest yield-curve inversion in history, which has the Federal Reserve Bank of New York forecasting a nearly 62% probability of a recession by August 2025.

- The first notable decline in U.S. M2 money supply since the Great Depression. Year-over-year drops of 2% or greater in M2 have historically correlated with depressions and high unemployment for the U.S. economy.

- The U.S. has navigated its way through a recession following 10 of the last 12 Fed rate-hiking cycles. It also hasn’t avoided a recession following cumulative fed funds rate hikes exceeding 310 basis points. The hiking cycle that began in March 2022 ultimately lifted the fed funds rate by 525 basis points.

All of these factors suggest the U.S. economy will weaken and adversely affect the price of various commodities and the pricing power of businesses. While this might be something of a silver lining for consumers, it has the potential to produce one of the weakest COLAs in history in 2026.

Once again, a lot can happen over the next 12 months. But with the prevailing rate of inflation rapidly declining and a few highly correlative recessionary indicators pointing to choppy waters, Social Security’s 2026 COLA doesn’t look promising.

The $22,924 Social Security bonus most retirees completely overlook

If you’re like most Americans, you’re a few years (or more) behind on your retirement savings. But a handful of little-known “Social Security secrets” could help ensure a boost in your retirement income. For example: one easy trick could pay you as much as $22,924 more… each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we’re all after. Simply click here to discover how to learn more about these strategies.

View the “Social Security secrets” »

The Motley Fool has a disclosure policy.

benzinga.com

benzinga.com