One of the more important decisions anyone makes as they near retirement is deciding when to claim Social Security benefits. It’s not a decision that should be glossed over, as it permanently affects your monthly benefits. This could matter a lot for people who plan to rely heavily on Social Security in retirement.

I used to think claiming at 70 was the better route because of the increased monthly benefits. However, after some thought and perspective, I now believe claiming at 62 is a great go-to for many people. Let’s take a look at why.

Image source: Getty Images.

How your benefits are affected by when you claim

When claiming Social Security, there are three ages to be aware of: your full retirement age, 62, and 70.

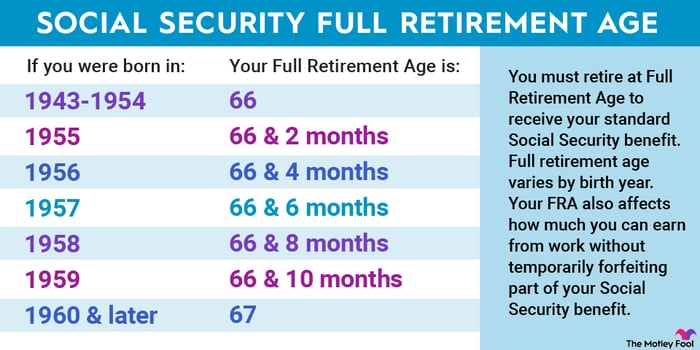

Your full retirement age is when you’re eligible to receive your primary insurance amount (PIA). Think of this monthly amount as your baseline around which everything else revolves. Below are full retirement ages based on your birth year:

Image source: The Motley Fool.

The second noteworthy age is 62 because that’s the earliest you can claim Social Security benefits. However, claiming before your full retirement age will permanently reduce your monthly benefit.

If you’re within 36 months of your full retirement age, Social Security will reduce your benefits by 5/9 of 1% monthly. Each additional month after 36 will further reduce them by 5/12 of 1%.

Assuming your full retirement age is 67, your monthly benefit will be reduced by 20% if you claim at 64 and 30% if you claim at 62.

Delaying benefits past your full retirement age will increase them by 2/3 of 1% monthly (8% annually), which is why 70 is the third noteworthy age. It’s the latest you can delay benefits and still get the monthly increase, so it’s generally thought to be the latest you should claim Social Security.

Once again, assuming your full retirement age is 67, delaying benefits until you reach 70 means you can expect a roughly 24% increase from your PIA.

Smaller for a longer time or larger for a shorter time?

When deciding between two ages to claim Social Security, I always encourage people to look at their breakeven age. That’s the age when the total benefits received from claiming Social Security at one age equal those of another age.

To see it in action, let’s assume someone is eligible to receive $2,000 in monthly benefits at their full retirement age. This means they receive around $1,400 by claiming at 62 and $2,480 by claiming at 70.

Keeping that in mind, here are the total benefits they would’ve received by certain ages.

| Claiming Age | Total by 75 | Total by 80 | Total by 81 |

|---|---|---|---|

| 62 | $218,400 | $302,400 | $319,200 |

| 70 | $148,800 | $297,600 | $327,360 |

Table by author.

For someone debating between 62 and 70, the breakeven age is just over 80.

Before then, the total benefits received from Social Security would be more by claiming at 62, even with the reduced monthly benefit. After that, the roles switch, with the total benefits received being higher by claiming at 70.

Use your breakeven age to provide perspective

For people debating claiming between 62 and 70, it comes down to this: Is it worth missing 96 monthly payments between 62 and 70 for the increased monthly benefit? That’s quite a bit of monthly payments that you can use to boost your retirement income.

If it were guaranteed that you’d live past the breakeven age, it could make delaying benefits an easier decision, but that’s no guarantee. For perspective, below are life expectancies at 62 and 70, according to the Social Security Administration.

| Gender | Life Expectancy at 62 | Life Expectancy at 70 |

|---|---|---|

| Men | 81.00 | 83.69 |

| Women | 84.07 | 86.00 |

Source: Social Security Administration.

There’s also the non-money factor to consider. Generally speaking, most people will find they’re more energetic and healthier in their younger years. Vacation plans and activities tend to look different for someone in the early to mid-60s than someone in their late 70s and early 80s.

Admittedly, these are broad generalizations, and there will always be exceptions, but the larger point is about giving yourself as much time as possible to enjoy your Social Security benefits (that you likely spent decades paying taxes for). This is particularly true if you won’t need the increased monthly benefits for your livelihood.

Even if your ideal retirement is sitting around and doing absolutely nothing (I don’t blame you), receiving your Social Security as early as possible gives you more financial flexibility to use it however you see fit.

At the end of the day, there’s no “right” or “wrong” time to claim Social Security. What matters is the time that works best for your personal situation.

The $22,924 Social Security bonus most retirees completely overlook

If you’re like most Americans, you’re a few years (or more) behind on your retirement savings. But a handful of little-known “Social Security secrets” could help ensure a boost in your retirement income. For example: one easy trick could pay you as much as $22,924 more… each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we’re all after. Simply click here to discover how to learn more about these strategies.

View the “Social Security secrets” »

The Motley Fool has a disclosure policy.

benzinga.com

benzinga.com marketbeat.com

marketbeat.com fool.com

fool.com