In August, more than 51 million retired-worker beneficiaries took home a Social Security check that averaged $1,920.48. While this might not sound like a lot of money, it’s been game-changing for more retirees than you might realize.

Based on an analysis from the Center on Budget and Policy Priorities, 22.7 million people were pulled above the federal poverty line in 2022 because of their Social Security income, including 16.5 million adults aged 65 and over.

Furthermore, Gallup has been surveying retirees annually since 2002 to gauge their reliance on their Social Security benefits. Between 80% and 90% of respondents, including 88% in the 2024 survey, consistently stated that their monthly check is needed to make ends meet.

Image source: Getty Images.

Considering how important this income is to the financial well-being of most retirees, there’s no announcement more anticipated than the annual cost-of-living adjustment (COLA) reveal. While Social Security’s 2025 COLA didn’t disappoint in one respect, the program’s lone silver lining for retirees comes at a steep cost.

Social Security’s COLA serves an important purpose

Social Security’s fabled “COLA” that you’re always hearing about is the tool the Social Security Administration (SSA) has at its disposal to adjust benefits to match the prevailing rate of inflation (rising prices).

In simpler terms, if the collective price for a basket of goods and services regularly purchased by seniors increases, Social Security benefits would need to rise by the same amount to ensure no loss of buying power. Social Security’s cost-of-living adjustment is the “raise” beneficiaries receive most years to account for the effects of inflation.

Since 1975, the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) has been tasked with tracking price changes for America’s top retirement program. The CPI-W has more than 200 separate spending categories, each of which has its own respective weighting. These percentage weightings allow the CPI-W to be represented as a single figure each month, which makes for easy year-over-year comparisons to determine whether prices are, collectively, rising (inflation) or falling (deflation).

Although the CPI-W is reported monthly, only the trailing-12-month readings ending in July, August, and September (i.e., the third quarter) are factored into Social Security’s COLA calculation. If the average third-quarter CPI-W reading from the current year is higher than the comparable period of the previous year, inflation has occurred and Social Security recipients are due a “raise.”

The year-over-year percentage difference in average third-quarter CPI-W readings, rounded to the nearest tenth of a percent, equates to the cost-of-living adjustment for the following year.

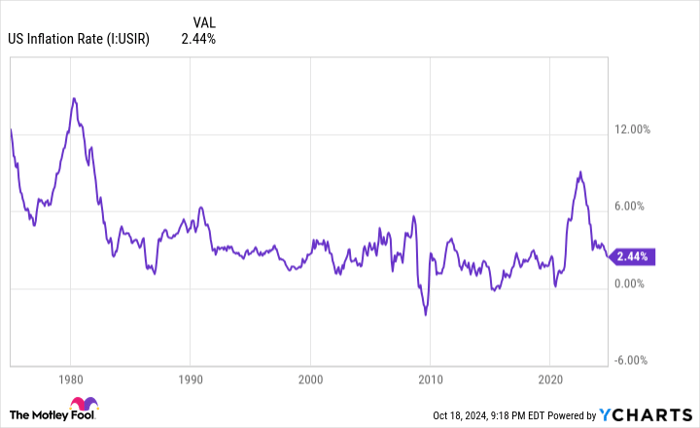

A sizable uptick in the prevailing rate of inflation has led to four consecutive years of above-average COLAs. U.S. Inflation Rate data by YCharts.

A silver lining for retirees: another above-average COLA

Throughout the 2010s, Social Security COLAs were mostly forgettable. This decade featured the only three years of deflation since the CPI-W became the program’s inflationary tether (2010, 2011 and 2016), resulting in no COLA being passed along, and the smallest positive COLA in history (0.3% in 2017).

However, the script has flipped in recent years. In 2022, 2023, and 2024, Social Security’s raise came in at 5.9%, 8.7%, and 3.2%, respectively. These considerably higher COLAs were fueled by a historic increase in U.S. money supply during the height of the COVID-19 pandemic, which sent the prevailing rate of inflation to a four-decade high.

Despite the 2025 COLA just missing out on a history-making moment, it did manage to deliver a fourth consecutive year with an above-average raise. On Oct. 10, the SSA reported that benefits would rise by 2.5% in 2025, which is modestly higher than the 2.3% average COLA over the prior 15-year period. An above-average COLA is certainly welcome following a period of an abnormally high rate of inflation.

Even though this is the smallest cost-of-living adjustment since the 1.3% raise passed along in 2021, it’ll still be noticeable in the pocketbooks of program recipients.

Based on estimates from the SSA, the average retired-worker beneficiary should see their monthly payout climb by $49 to about $1,976 (roughly $23,712 annually) next year.

This 2.5% increase is applicable to workers with disabilities and survivor beneficiaries as well. The average Social Security check for both classes of beneficiaries is forecast to rise by $38 per month in 2025 to $1,580 for workers with disabilities and $1,551 for survivors of deceased workers.

Image source: Getty Images.

Social Security’s above-average COLA comes at a hefty price for retirees

While next year’s cost-of-living adjustment looks decent on paper, most retirees will soon discover that this above-average raise comes at a hefty cost.

As the full name of the CPI-W implies, it’s an inflationary index tasked with tracking the spending habits of “urban wage earners and clerical workers.” These are prominently working-age Americans who aren’t currently receiving a Social Security benefit.

The issue is that seniors, who comprise 86% of all Social Security beneficiaries, spend their money quite differently than working-age Americans. Specifically, a higher percentage of their budget goes to shelter expenses and medical care services than the typical working-age individual. Shelter is the largest-weighted component within the CPI-W.

According to the September inflation report from the Bureau of Labor Statistics, the trailing-12-month rate of inflation for shelter and medical care services clocked in at 4.9% and 3.6%, respectively, for the Consumer Price Index for All Urban Consumers (CPI-U), which is a similar inflationary index to the CPI-W. In other words, the spending categories most responsible for producing Social Security’s fourth consecutive above-average COLA are those that matter most to retirees.

The issue here is twofold. First, the CPI-W isn’t adequately accounting for the expenses (shelter and medical care services) that are most important to seniors. Second, if the prevailing rate of inflation for shelter and medical care services continues to meaningfully outpace the 2.5% COLA being passed along in 2025, it’ll almost certainly lead to a loss of buying power for retired workers.

An analysis released in July by the nonpartisan senior advocacy group The Senior Citizens League found that the purchasing power of a Social Security dollar had declined by 20% since 2010. Chances are that this loss of buying power will worsen in the upcoming year.

The $22,924 Social Security bonus most retirees completely overlook

If you’re like most Americans, you’re a few years (or more) behind on your retirement savings. But a handful of little-known “Social Security secrets” could help ensure a boost in your retirement income. For example: one easy trick could pay you as much as $22,924 more… each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we’re all after. Simply click here to discover how to learn more about these strategies.

View the “Social Security secrets” »

The Motley Fool has a disclosure policy.

marketbeat.com

marketbeat.com benzinga.com

benzinga.com